how to become tax exempt at home depot

Find the document you want in our library of legal templates. Provide a detailed business purpose.

Supplyworks The Home Depot Pro Institutional Office Work And Janitorial Supplies The Home Depot Pro Institutional

Choose your tax-exemption reason from the drop-down menu that appears after Add is clicked in the previous step.

. Online Tax Exempt Application. Open the form in the online editor. Home Depot Tax Exemption Document Author.

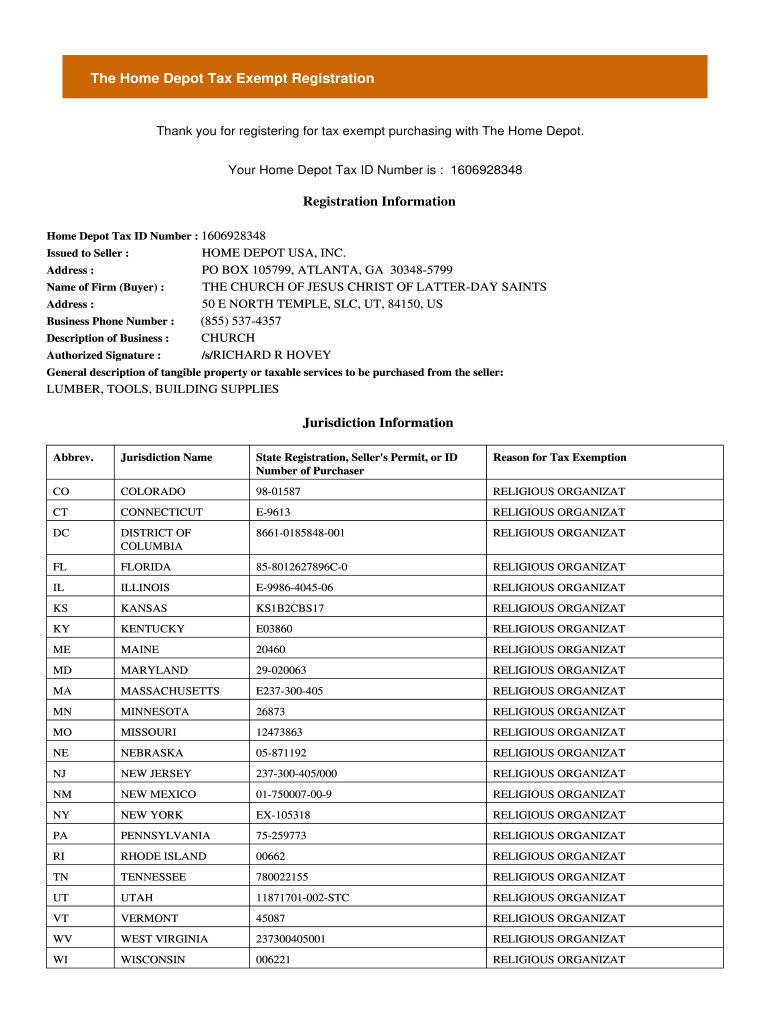

Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. If you already have a The Home Depot tax exempt ID skip to Step 10. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number.

The ID number will be numeric only and is displayed on the printed registration document. The Home Depot Inc. The documentation will be veried.

Home Depot Tax Exempt Registration Form - Solving the difficulty of finding apartments for users. Easily follow these steps and start dropshipping using Home De. A hold-your-hand video that will help you gain tax exemption from Home Depot.

It takes only a few minutes. Home Depot Tax Exemption Document Created Date. Establish your tax exempt status.

Home Depot Tax Exemption Document Author. All I would like to know is if Home Depot requires Nexus in each state that is being filed for tax exemption since the application demands a separate sales tax ID number. Here it is guys.

The Home Depot Inc. 877 434-6435 Option 4 Option 6 9 am. Apply for an EIN.

Your Home Depot Tax ID Number. If youre tax exempt in multiple states you can update your tax-exempt status through your administrator account profile. All information related to Home Depot Tax Exempt Registration Form is properly updated and moderated.

Enter your state sales tax exemption number in the field labeled Identification Number. This might not be the best place to ask this but it shouldnt hurt to try. Please include your contact information.

To shop tax free you need a Tax Exempt ID from The Home Depot. If youre picking product up or shipping product to a state where youre currently not registered as tax exempt youll be charged tax. Click Add on the right side of the screen.

Tax is calculated based on the final destination of the product. The Home Depot Tax Exempt ID number is used when making tax exempt purchases in lieu of the state issued tax exempt ID number. Please print out and complete the following tax exempt application and attach any applicable state specific.

Steps for obtaining tax-exempt status for your nonprofit. In order to comply with state and local tax laws we must have in our files a properly executed exemption certificate given to us in good faith from all our customers who claim sales tax exemption. Im currently filling out the Home Depot Tax Exempt Application.

Select the fillable fields and put the necessary data. This includes name address andor telephone number. This number is different from your state tax exemption ID.

View or make changes to your tax exemption anytime. Complete the state-level application if applicable. Use your Home Depot tax exempt ID at checkout.

Home Depot Tax Exemption Document Created Date. The number is auto assigned by the system during the registration process. Pay the necessary filing fees.

Users can access it for free to serve their own home-finding needs. Keep to these simple instructions to get Home Depot Tax Exempt ready for sending. All registrations are subject to review and approval based on state and local laws.

File Form 1023 with the IRS. Select the state that your company is registered in from the box on the right. The Home Depot Sites The Home Depot The Home Depot Canada The Home Depot Mexico Need help with your registration.

ET Monday through Friday View Tax Exempt Customer FAQs. If we do not have this certificate we are obligated to collect the tax for the state in which. The Home Depot Tax Exempt Registration Thank you for registering for tax exempt purchasing with The Home Depot.

To get started well just need your Home Depot tax exempt ID number. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygovAs of January 5 2021 Form 1024-A applications for recognition of exemption must also be submitted. Read through the recommendations to determine which info you will need to give.

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller

10 Ways To Be Tax Exempt Howstuffworks

Home Depot Tax Exemption Application Youtube

Digital Marketing How To Choose The Right Niche Cashflow Quadrant Investing Books Investing Money

Home Depot Tax Exemption Application Youtube

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

Home Depot Tax Exemption Application Youtube

Filing Requirements For Tax Exempt Organizations Tax Return Tax Internal Revenue Service

Tashapb I Will File Your Uk Company Accounts And Tax Return For 110 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

How To Find Home Depot Tax Id Fill Online Printable Fillable Blank Pdffiller

How To Register For A Tax Exempt Id The Home Depot Pro

Requirements For Tax Exemption Tax Exempt Organizations

Have You See Robert Kiyosaki S Cashflow Quadrant It S Here Learn Earn Robert Kiyosaki Kiyosaki